Amid the economic uncertainty, climate investing is bucking the downward trend

By Moritz Jungmann, Investment Partner Future Energy Ventures

Soaring energy prices, rising interest rates, negative economic headwinds, and fluctuating stock prices have meant that the past year has been a period of re-adjustment for investors. Yet, despite this uncertainty, decarbonization is a megatrend; driven by the need to reach net zero by 2050 if the world is to avoid catastrophic climate change.

For the economy, business and investors, decarbonization means massive change and a need to completely re-build energy infrastructure. This presents significant investment opportunities.

The challenge is that the necessary steps to decarbonize the world are all happening at the same time and they all require investment; which calls for huge strategic choices for the investment community. Navigating that is helped when you frame the decarbonization challenge into separate stages:

- To decarbonize, the world needs to electrify (and stop using fossil fuels for energy);

- To decarbonize and electrify, the world needs to build renewables;

- To decarbonize, electrify and integrate renewables, the world needs smart software solutions to manage a multi-tenant system.

For all these reasons, investing in the energy transition today builds on solid ground and creates significant investment opportunities. This is particularly true for venture capital funds that are focused on energy transition software technology where getting ahead in the next 12 months is essential.

[Learn more about decarbonization: /awakening-the-giant-decarbonizing-the-heating-sector-in-europe-and-beyond/]

Governments and regulators have set up a new playground for private investors

Governments around the world have reacted to the energy crisis and understand the need for systemic change, introducing new legislative frameworks to encourage significant investment in renewables, reducing costs to the public and boosting domestic energy security.

In the USA, the landmark Inflation Reduction Act laid the ground for $369 billion in federal aid directed at energy efficiency improvements and renewables infrastructure. A large proportion of that funding (around $216 billion1) comes in the form of tax credits designed to encourage private investment in renewables infrastructure. Meanwhile, the EU recently announced the Net-Zero Industry Act to rival this plan, and “make Europe the home of cleantech and industrial innovation on the road to net-zero”.

These and other policies introduced by governments globally have led the IEA2 to predict that global clean energy investments will rise by more than $2 trillion a year by 2030, a 50% increase from today.

Separate analysis by Bloomberg NEF3 has stated that it is now cheaper to build and operate new large-scale wind or solar plants than to run an existing coal or gas-fired plant. With global governments already under pressure to sign binding agreements to ‘scale down’ fossil fuel use at COP28 in November 2023, the economic and political case for developing renewables to replace existing energy infrastructure as well as for new energy capacity is growing.

Globally, meeting the Paris targets of 1.5C and achieving net zero by 2050 will need around $125 trillion of climate investment according to the UNFCC4, and we will likely need more as recent reports indicate continued increases in carbon output. The reality is that governments cannot meet the cost of this transition alone, so there is a huge appetite for private investment. And the sheer growth and investment needed is creating a new global energy infrastructure that will see consistent demand regardless of economic conditions.

[Learn more about accelerating energy transition: /flexibility-the-key-to-accelerating-energy-transition/]

Different asset classes, different expectations, different opportunities

Investments in physical renewable generation assets are mainly taken by project developers and corporates. Financing is often based on private market instruments, such as bonds (6-7%, 6y-10y), which indicate a relatively risk-mitigated investment with solid upside opportunities for investors. Market turbulence in 2022 seems not to have had a negative effect on this asset class either. Combined with the regulatory incentives that are in place to accelerate investment into decarbonizing energy, investment in renewable energy infrastructure and software has the ability to cut through market cycles. Plus, increased interest rates as well as the project pipeline could set the path for even higher returns.

There is also an opportunity to invest where the big energy companies can’t. Established players are constrained by their regulated business operations, having to focus on grid and other critical infrastructure. Focusing their investment on these areas means reduced financial power to address the development of other renewable infrastructure. As a result, the integral technology – software in particular – that connects the dots of a much more decentralized energy system offers an interesting window of opportunity for investors and tech entrepreneurs.

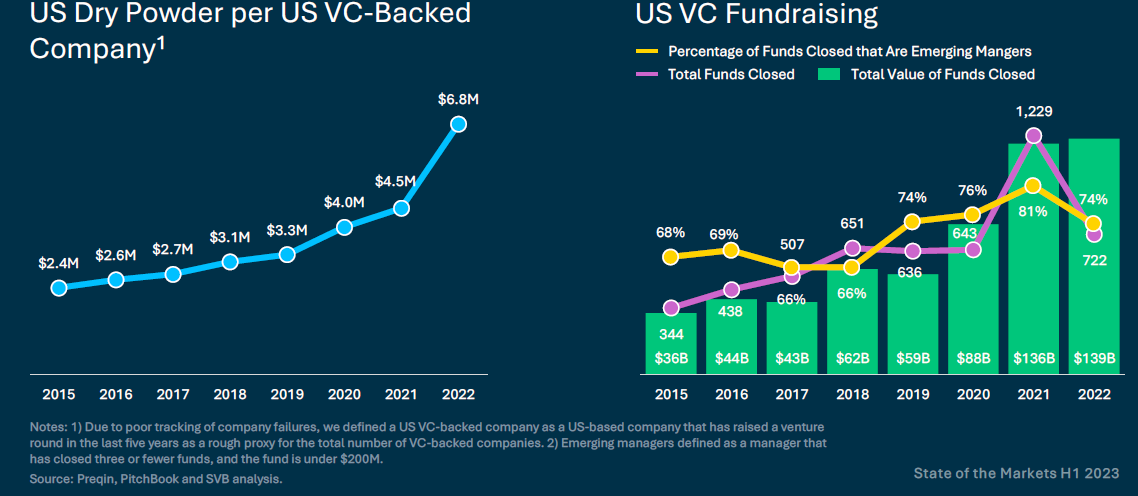

According to analysis from Climate Tech VC5, venture capital fundraising in the climate investment space has broken new records, with $151 billion in new funds being raised in 2022. There is an all-time high level of undeployed capital, or so-called dry powder, currently available within the industry.

With fund cycles in mind, it is reasonable to expect that these funds will be deployed throughout the next 3-5 years with matching investment opportunities for other investors. Figures just released by Silicon Valley Bank highlight the amount of dry powder available for investment.

Source: State of the Markets from SVB, February 2023

Source: State of the Markets from SVB, February 2023

It is not just investment opportunity that is driving the thirst for renewables and new energy systems, it is also risk. The cost of renewables is now less than other forms of power, and global sentiment is turning against coal and other fossil fuels. This means there is a new risk for investors in placing money into traditional energy infrastructure and technologies as they could become a ‘stranded asset,’ marooned by changes in government policies and ESG investment criteria.

Investors are already looking for growth and returns within the renewables and climate tech industries but there are plenty of opportunities still to find for those looking to buck the current economic headwinds and back the transition from brown to green.

A version of this article was originally published by ESG Investor.

Sources:

- https://www.mckinsey.com/industries/public-and-social-sector/our-insights/the-inflation-reduction-act-heres-whats-in-it

- https://www.iea.org/news/world-energy-outlook-2022-shows-the-global-energy-crisis-can-be-a-historic-turning-point-towards-a-cleaner-and-more-secure-future

- https://www.bloomberg.com/news/articles/2021-06-23/building-new-renewables-cheaper-than-running-fossil-fuel-plants?leadSource=uverify%20wall#xj4y7vzkg

- https://climatechampions.unfccc.int/whats-the-cost-of-net-zero-2/#:~:text=%24125%20trillion%20of%20climate%20investment,put%20the%20world%20on%20track

- https://www.ctvc.co/new-dry-powder-for-a-new-climate/?ref=CTVC-newsletter