Quantitative Approach to Environmental Impact

Our Impact Approach is not intended to be unique. Hear us out.

In fact, our hope is that impact assessments of climate solutions, including forward-looking assessments, one day become demystified and that investors convene around a standardized methodology – just like we do for financial analysis and reporting. To this end, we welcome and work actively with peers to drive more collaboration between investors, and also involvement by LPs and startups, on impact.

Future Energy Ventures contributes to the Content Working Group of Project Frame, a nonprofit initiative purpose-built to organize investors around forward-looking emissions impact methodology and reporting best practices. Our own approach closely aligns with the Project Frame methodology. Future Energy Ventures is also part of the local steering committee for the Germany branch of ImpactVC – a community of impact focused investors coming together to further mature the field of impact measurements and management in the venture capital space.

This section summarizes our approach to impact, and will evolve with our thinking on the subject.

Our approach takes 6 steps:

I. Strategy and sourcing

Fortunately, most of the technologies needed for net-zero are available today, ready to scale. Such technologies include all the energy transition hardware we all know well, EVs and charging infrastructure, solar PV and wind turbines, heat pumps, meters. With new business models and supportive policies, these can achieve 65% of the progress towards net-zero.

Unfortunately, the solutions are not scaling fast enough, and their full potential often remains untapped. On their own, each hardware piece is an isolated island, not taking the needs of the wider system and society into account – and not benefiting from the immense opportunities posed by connectivity and intelligence. Such lack of innovation hinders the accelerated deployment which could otherwise be unleashed. So, to tie it all together, to optimize, balance, shift, scale and improve, software solutions are key.

For us at Future Energy Ventures, we see digital and hybrid business models as true game-changers. And we believe investing in such early-stage game-changers can be a low-cost way to achieve large scale climate impact through cutting GHG emissions.

At the first stage, we screen for companies within our strategic areas Future Energy, Future Cities and Future Technologies, and we particularly look for companies whose impact is intentional, and where it is likely to be highly scalable and substantial in scope.

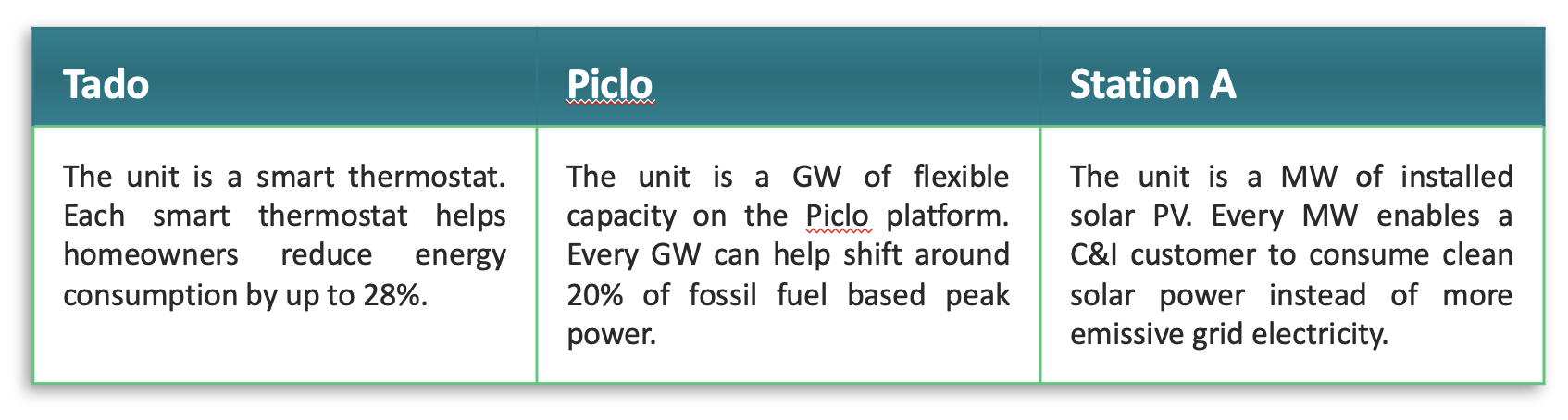

II. Impact thesis and Unit impact

The next step is one of the most challenging and company-specific steps. First, we articulate all the ways in which the climate solution will abate CO2e emissions compared to status quo or an incumbent solution, then we quantify the various effects at the unit level. This step requires an extensive understanding of the company’s solution, consulting industry experts, peer-reviewed science, and Life-Cycle Analyses, and competitive solutions where relevant. It also requires defining the baseline against which the innovation will be compared. Helpful resources for this part include the global scenarios by the International Energy Agency, like the Stated Policies and Announced Pledges scenarios.

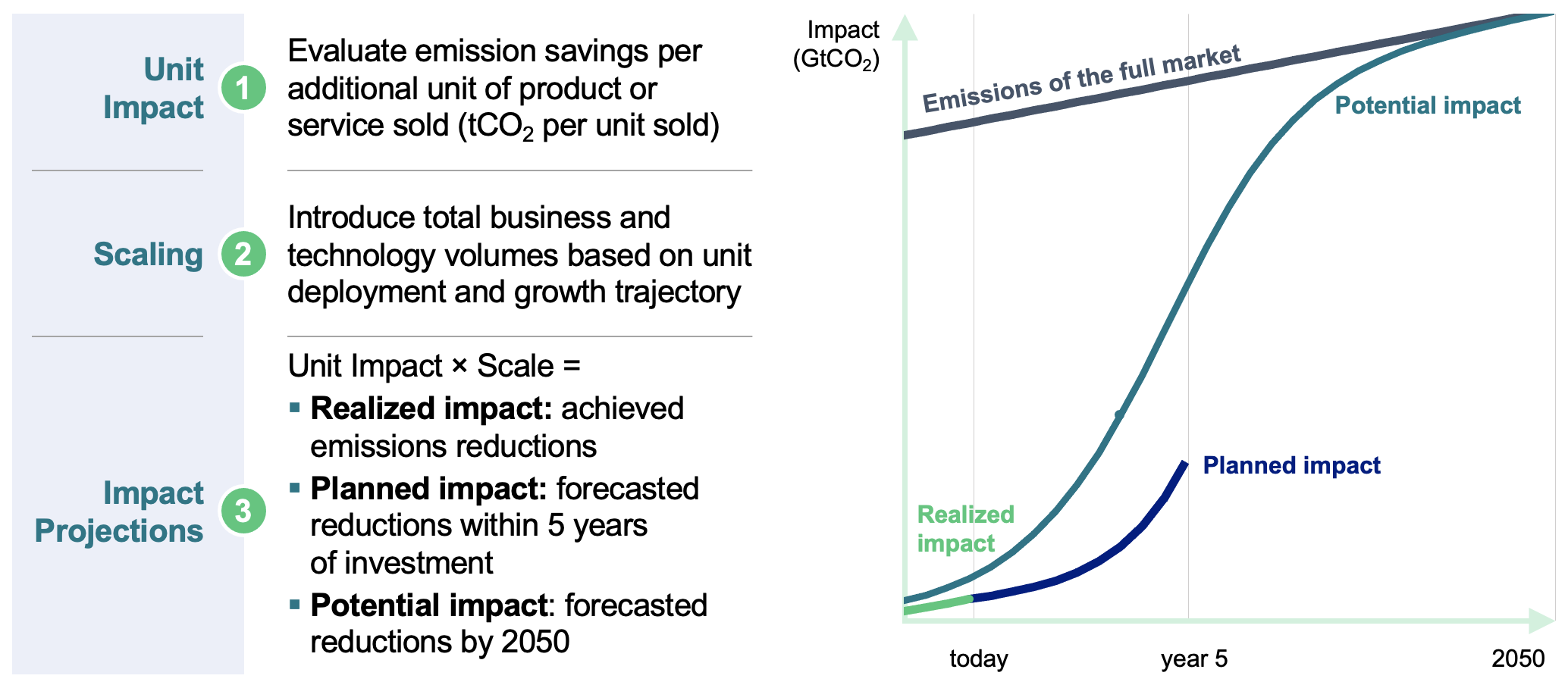

III. Scaling

“If it does not scale, I don’t care” – said one of our founders at one point, and we agree. Climate change mitigation is the game of big numbers. This is why in this step we combine the unit impact with commercial forecasts and broader market analysis in two time horizons: Planned (next 5 years) and Potential (until 2050). We also apply an adjustment factor (0-100%) on the final impact figure to account for that in most cases, a company only contributes to a part of the value chain and as such should only get credit for part of the impact. For example, they might manufacture and supply new innovative solar panels, but do not provide the smart data platform for asset connectivity and optimization, or they might offer a marketplace for energy efficient appliances, but did not actually invent or manufacture the appliances.

Planned Impact

Multiply unit impact with the Company’s business plan for the coming years to forecast its planned impact. At FEV, we focus on what the companies plan to achieve by the time of exit, assumed to be 5 years post investment, as well as during the lifetime of the Fund (10+2 years).

Potential Impact

In this section, we shift focus from an individual company to the broader technology level, which includes competitors as well. We predict the long-term impact of the company’s solution by analyzing the market and assuming growth follows a standard technology adoption s-curve. We focus on the question “if this solution succeeds wildly, how large is the impact?” or in other words, “Is this type of solution worth our time?” This method puts all companies on an even playing field, removing the need to make specific guesses about market capture in a competitive landscape. This approach helps us identify truly exceptional and impactful solutions, regardless of which company ultimately leads the market. Additionally, we are confident that we can influence the pace of scaling (i.e., market share captured). Competition between solutions is inherently beneficial– the world needs decarbonization more urgently than ever, and healthy rivalry drives innovation. The s-curve method is a simple and effective way to see what share of global emissions portfolio companies are attacking – what ballpark we are playing in.

IV. Evaluate

As part of due diligence, the decision materials ensure the forecasted impact passes a set of minimum thresholds. In addition, considering escalating risks and the compounding effects of emissions on climate change, abating a ton of carbon today has a greater impact than abating a ton tomorrow. We prioritize measurable decarbonization impact during the lifetime of the fund, over impact further out in time. The impact forecasts are always part of the decision materials, considered by the investment committee.

V. Track and report

We track the impact performance of the overall portfolio of the Fund and each individual portfolio company as part of advising the AIFM and progress is reported to LPs. For deeper insights into the impact of the Fund’s portfolio, we track underlying Impact KPIs causing the impact such as energy saved, or flexibility enabled, in addition to the realized emissions avoidance. We also track an adjusted number of the impact based on the Fund’s equity ownership percentage, aka. the Fund’s „impact pro-rata” (i.e. claiming only 10% of the impact, if the Fund owns 10% of the enterprise value). This way we can assess how much impact resulted from the capital invested, as well as the cost per ton abated.

The Fund, together with the AIFM, is responsible for the ESG and Impact reporting. FEV, as an advisor to the AIFM monitors ESG and impact performance and supports the reporting efforts as part of the advisory activities.

VI. Review

The final step of our impact approach is to review and if required, adjust the impact model on an annual basis to incorporate new research or company results.

We recognize our approach requires further refinement; however, it represents a substantial stride toward progress, and we encourage other funds to adopt similar strategies. For instance, we have yet to conclude on the best approach for the challenge of value chain adjustment. Currently, we strive for appropriate discounting on a case-by-case basis, and we work on guidance on the topic with other leading climate-tech funds.