Investment Insights: reev

Crossing the chasm

Transportation contributes to over 20% of global greenhouse gas emissions, with a significant portion coming from passenger cars. Electric vehicles (EVs) offer a solution to reduce these emissions. EVs have been around for over a decade and initially attracted early adopters. These customers accept early technology issues like high costs, unreliable performance, or extra effort required to use the product. These early buyers are usually wealthier users, who can afford the premium price and they often have access to private charging stations, which makes vehicle operation more convenient and comfortable. As EVs remain more expensive than traditional cars, and there is a strong link between EV sales and home charging installations, indicating that there is still a long way to go – the harder to grasp market is still very much untapped.

If technology is supposed to become mainstream, the EV offering needs to become more appealing and accessible to a wider range of consumers beyond small group of buyers who can afford it and are willing to make extra effort. This is particularly challenging in urban areas where many people do not have access to private parking and relay on landlords or employers for providing charging facilities. Since most often charging will take place at home or work, due to growing EV adoption the demand for semi-public charging infrastructure, (including offices, multi-tenant apartment buildings, and hospitality venues) will increase. Site hosts are fundamentally unprepared for that.

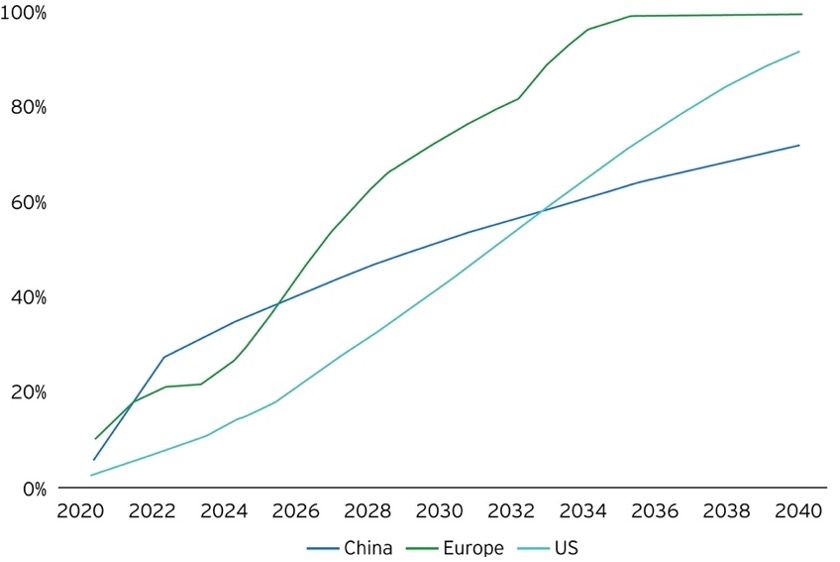

EV sales forecast for China, Europe and the US, from 2020 to 2040 as a percentage of market share, EY 2023

Why is it difficult?

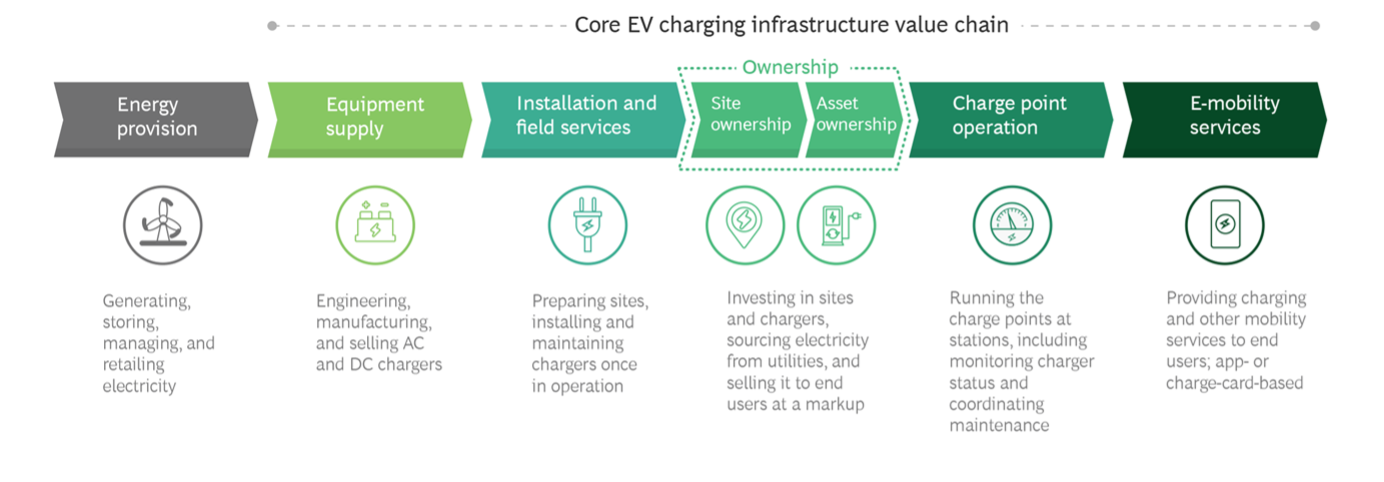

Currently, most non-private charging stations are usually managed by well-established players such as oil and gas majors or energy utilities, who recognized a business opportunity in running large networks of public charging points (charge point operator, CPO, enabled by leaders like our portfolio Virta). However, this CPO approach doesn’t match the needs of building operators because of the smaller scale and high fragmentation of projects. Also, dealing with different kinds of semi-public customers makes it tough to figure out how to distribute the charging hardware and go to market. There are various players involved, like hardware vendors, wholesalers, project planners, large installers, local electricians, which makes it hard to integrate into the value chain (plus many building owners already have their own technicians they prefer to work with).

Setting up the infrastructure is challenging, but operating it is even harder. Semi-public charging stations have complex usage patterns and high demand, with multiple users accessing the same station. Additionally, it can be also open to wide public use at certain times of the day (thanks to our portfolio Hubject). Furthermore, there are physical limitations within buildings. While smart charging at home focuses on cost savings and using green power (innovation led by our portfolio ev.energy), in large buildings where power capacity is a serious constraint, the infrastructure must be intelligent and flexible to manage fluctuating consumption levels. In a semi-public setup, a charging point without smart software is not an option.

The EV charging value chain, BCG 2021

Why reev

Even if the next wave of EV adoption will come from urban environments, it’s a very challenging market to tackle. In the semi-public case charge points are installed and configured by non-specialized electricians, and so bringing the charge point online and available for software application, have to be easy to set up. If every building operator becomes a small CPO himself, the software to administer users has to be as simple to operate as possible. To address these challenges, specialized solutions are needed to cater to the unique requirements. reev is the semi-public specialist and market leader in DACH.

reev offers a cloud-based charging software designed to simplify the implementation of eMobility infrastructure for site owners. Their self-service SaaS is heavily “productized” (offers standardized features) to ensure repeatability in heterogenous semi-public case. As the solution is distributed through multipliers (hardware suppliers, wholesalers, installers), it was made simple to activate and requires minimal setup. reev software turns distribution partners into turnkey solution provider, and over time it became a trusted brand among installers . Another great mass market enabling feature is high infrastructure uptime. The software provides technical oversight for troubleshooting and reev excels in customer service, quickly resolving issues and ensuring uptime, which is crucial across all the providers in the ecosystems, who are involved. The software includes comprehensive administrative features, such as access control, user management, and real-time monitoring, paired with an intuitive end-user interface. reev has demonstrated its ability to be swiftly deployed on charging stations and is expanding its offerings to address grid limitations through the development of an in-house energy management system.

reev’s team has a truely entrepreneurial spirit with deep roots in energy management. The company recognized a market opportunity within their segment and, by being crazy focused on product and customers, has built a strong product-market fit over time. reev’s passion to emobility and commitment to the energy transition are acknowledged by both distribution partners and customers, making them a reliable and enjoyable partner. With their branded software, established market presence, seamless integration with hardware providers, and great reputation, reev is positioned for sustained growth and market dominance. We look forward to working together with Blue Earth Capital team and reev.