Under the Radar: Climate Impact and Investment Opportunity in the Built Environment

By Anna Trendewicz and Net Zero Insights

Accounting for approximately 37% of total global greenhouse gas emissions (GHG), the built environment stands out as a major contributor, with projections indicating a potential doubling by 2050 if no reduction measures are applied, as per the Climate Group[1].

In the global battle against climate change, climate tech has emerged as a pivotal sector with 70% of the VC investments in the buildings sector being now allocated to climate-positive solutions[2]. According to the International Energy Agency (IEA), to align with the Net Zero Emissions Scenario, the building sector needs more than 50% reduction by 2030, which is an average yearly reduction rate of about 9%[3]. As per an estimate from the 2022 McKinsey report, that necessitates a substantial yearly investment of $1.7T in the building sector[4].

Commercial buildings, which constituted 38% of emissions in the built environment in 2022 (excluding construction)[3], wield a significant impact potential. We believe this sector is well positioned for change driven by motivations such as regulatory support from initiatives like the Inflation Reduction Act (IRA) in the US, the EU Green Deal in Europe, energy price volatility, high interest rates, tightening environmental regulations, and capital markets’ pressure on non-ESG-compliant assets. A more centralized real estate management of large portfolios ensures fast scaling.

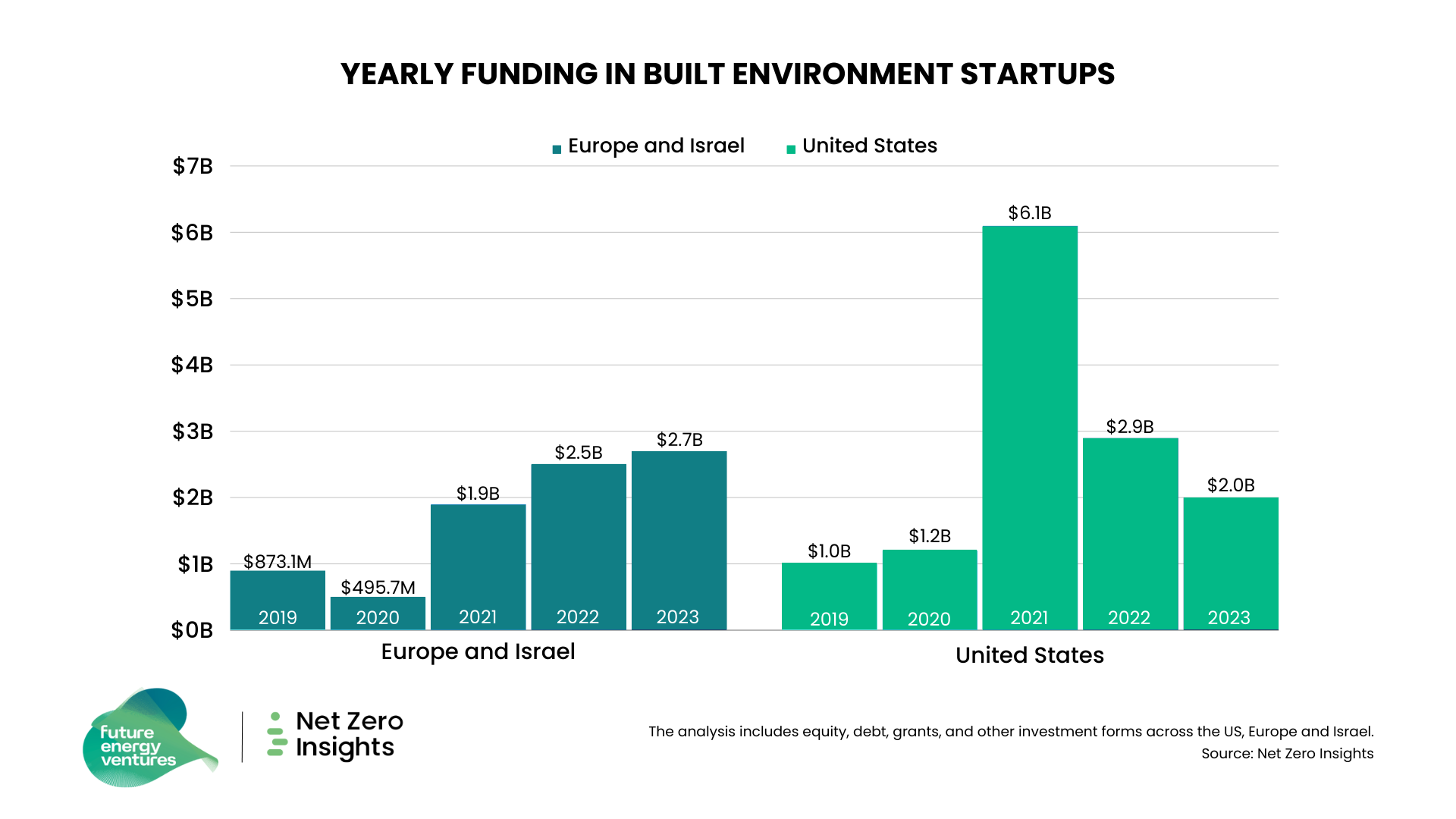

As per data from Net Zero Insights, in 2023, climate tech startups collectively raised about $70B in venture funding across equity, debt and grants, out of which the built environment accounted for a slim share of 8%, raising $5.4B across 288 deals. On the other hand, while global investment in climate tech declined by approximately 30% year over year, the built environment segment saw “only” a 10% decline in VC funding from the $6B raised by ventures globally in 2022, proving the resilience of the segment despite the global downturn.

At Future Energy Ventures, we believe this trend is due to substantial underinvestment in the built environment, which we see as an opportunity to create a positive climate impact and generate outstanding returns. That is only one of the many reasons we have invested in tado° and Dabbel, two start-ups aiming to reduce GHG from residential and commercial buildings, respectively.

Despite the negative trend since the 2021 peak, US-based companies maintained their dominance in the built environment sector in 2023, securing the top position by raising $2B. However, Europe and Israel collectively surpassed the US for the first time, raising a total of $2.7B, and showing positive growth for the third consecutive year.

The European market shows Germany as a solid rising star, leading investments for the third year in a row with $1.4B, representing almost half of the activity in the region. France stood second at $427M, and the UK took the third position at $376M. All three European countries experienced significant year-on-year increases — with France growing the fastest (28% YoY), followed by the UK (24% YoY) and Germany (7% YoY). Globally, the top cities in terms of dollars invested were Berlin, Hamburg (majorly due to 1KOMMA5 headquartered in Hamburg, raised €430M in Series B in 2023) and Toronto.

Software solutions provide decarbonization impact at speed and at scale for commercial buildings

Software solutions can be implemented and scaled at lightning speed due to their digital nature, generating massive emission cuts. For example, energy management software such as Dabbel, aedifion or R8Tech can result in up to 30% energy consumption reduction in commercial buildings, while digital decarbonization roadmaps such as those offered by Optiml, KammaData, and Station A accelerate the retrofit process, starting with highest impact and most economical locations.

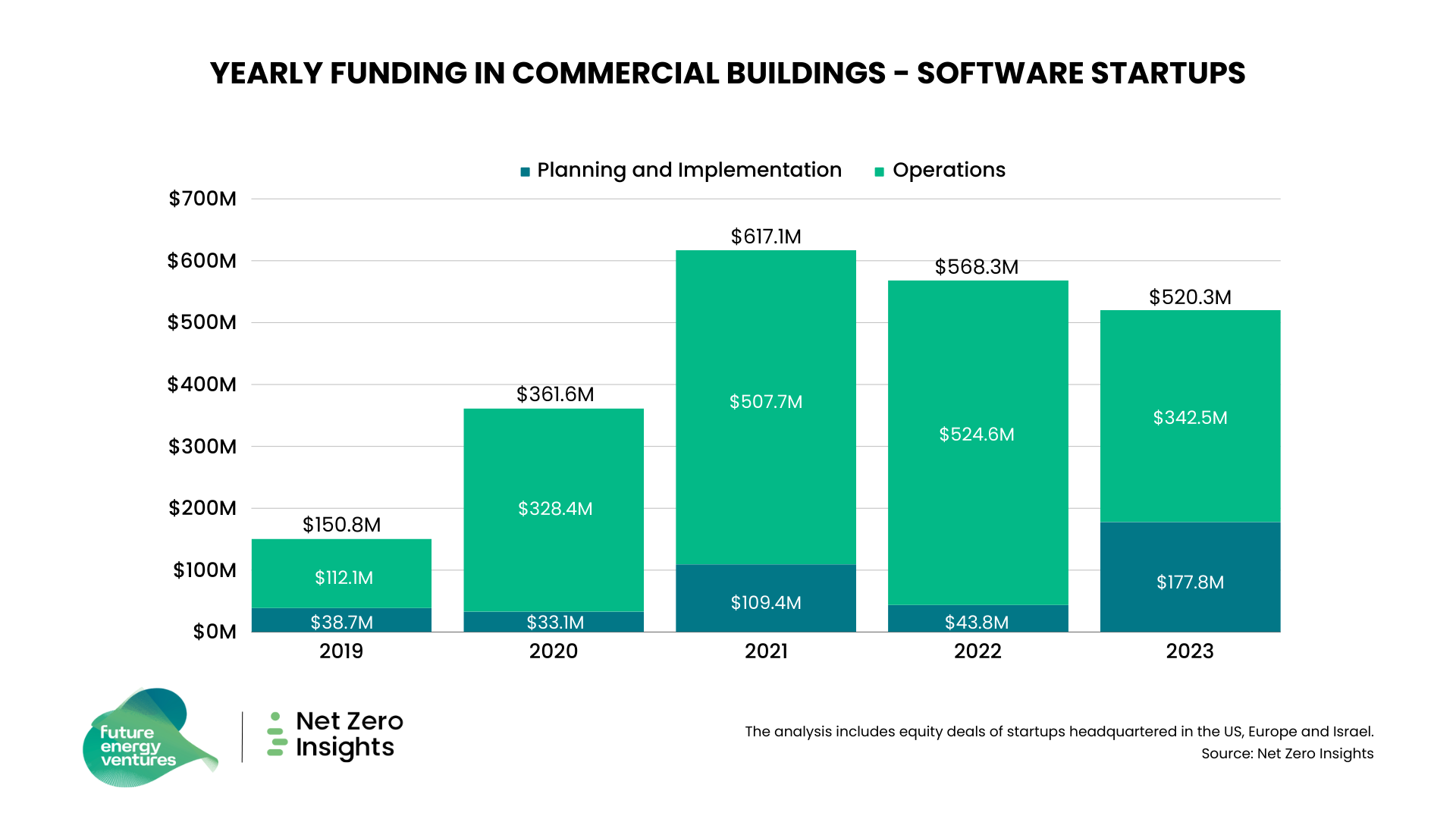

The gigantic opportunity to decarbonize commercial buildings with software solutions has been attracting investors‘ attention. Over the past five years investments in this field across the United States, Europe, and Israel have more than tripled, going from $151 M in 2019 to $520M in 2023, according to data from Net Zero Insights. That’s an average growth rate of about 36% per year.

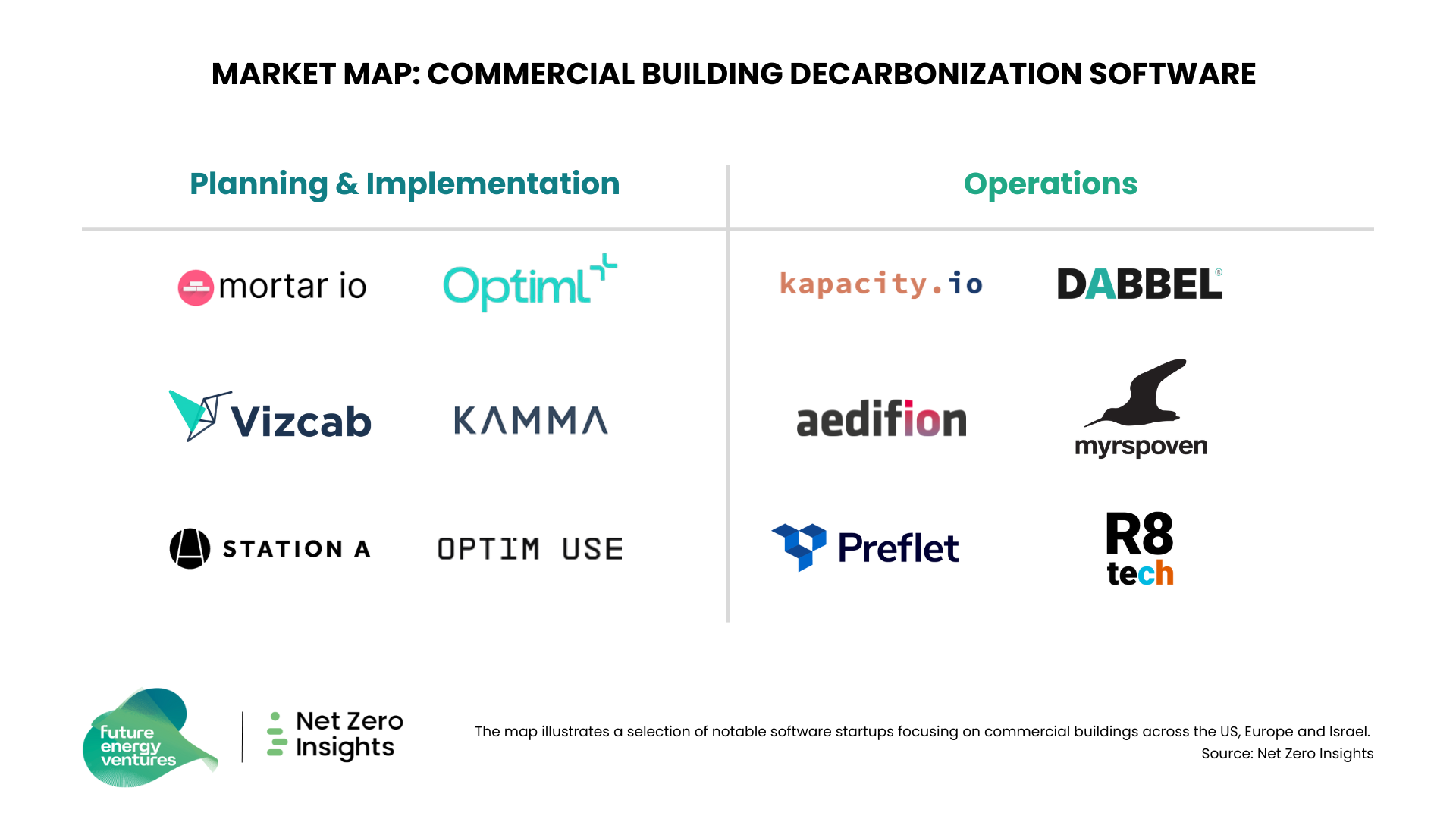

When examining startups in this sector, we can broadly categorize software solutions for commercial buildings into two primary domains: Planning & Implementation, and Operations.

Planning & Implementation is centered around identifying high-potential opportunities that yield maximum returns. In Europe, where 90% of the building stock that will exist in 2050 has already been constructed today, retrofitting existing buildings emerges as the forefront area in sustainable investment. Software solutions providing visibility into physical, financial and environmental metrics, as well as simplifying procurement, play a pivotal role in making informed decisions and taking strategic actions.

Operations are addressing the building’s energy consumption in the operational phase, which accounts for 30% of global final energy demand[3]. Energy is often wasted due to a lack of visibility into demand, supply, and the discrepancies between the two. Software solutions like Dabbel, aedifion or R8Tech can address these issues through visualization, monitoring, and optimization of energy systems. As a result, they not only enhance comfort but also provide higher energy efficiency, lower costs, and increased utilization of renewable energy sources.

According to Net Zero Insights data, in the last five years, startups in the US, Europe, and Israel, targeting software solutions for commercial building operations, secured $1.8B—representing 80% of the total capital invested in software for commercial buildings. However, a noticeable surge in Planning and Implementation solutions suggests an even steeper growth rate. In 2023 alone, Planning and Implementation software companies raised $177M, the highest amount to date and equivalent to 50% of the total raised by the Operations segment in the same year. This shift was primarily fuelled by the US, where three early-stage planning & Implementation startups collectively raised $174M in 2023 alone. The remaining $3M were divided among four seed-stage startups in Europe.

The market map below illustrates a selection of notable software startups focusing on commercial buildings across both Planning & Implementation and Operations segments across the US, Europe and Israel.

The decarbonization of commercial buildings is a huge climate impact and investment opportunity, which is still largely under the radar (only 8% of venture funding) and growing fast despite the market downturn. Europe is leading the investment activity growth within the built environment sector with Germany, France and the UK being the top three investing countries. Digital solutions can be implemented at lightning speed and at scale contributing to up to 30% of energy efficiency improvements and accelerating retrofits, starting from the highest impact and most economical locations.

References

[1] https://www.theclimategroup.org/built-environment

[2] AO PropTech, State of Built World Tech 2023, https://www.stateofbuiltworldtech.com/

[3] https://www.iea.org/energy-system/buildings, commercial buildings emissions: 3.7 Gt CO2, residential buildings emissions: 6.1 GtCO2, construction 2.5 Gt CO2

[4] https://www.mckinsey.com/capabilities/sustainability/our-insights/the-net-zero-transition-what-it-would-cost-what-it-could-bring